Comprehending the Value of Insurance Policy: Safeguarding Your Future

In today's unforeseeable globe, recognizing the importance of insurance is important for securing your economic future. Insurance not only serves as a buffer versus unforeseen occasions however likewise equips individuals to seek their desires with self-confidence.

What Is Insurance coverage?

Insurance is a contractual plan that offers monetary defense versus prospective future losses or liabilities. Essentially, it works as a protect for people and organizations, enabling them to move the risk of unpredicted events to an insurance policy business. This mechanism operates the principle of threat merging, whereby numerous customers contribute costs to a collective fund. When a protected loss happens, the insurer pays out funds to the influenced event, therefore minimizing their monetary worry.

The essential components of insurance include the insurance holder, the insurer, the premium, and the coverage terms. The policyholder is the individual or entity acquiring the insurance coverage, while the insurance firm is the business giving the coverage.

Kinds Of Insurance Insurance Coverage

A wide range of insurance policy protection options exists to attend to the diverse demands of individuals and organizations. Each kind of insurance coverage offers a distinct function, using defense against particular risks.

Health insurance policy is important for covering medical expenses and making sure access to health care solutions. Vehicle insurance policy protects automobile owners from financial losses as a result of accidents, theft, or damages to their autos. Property owners insurance policy safeguards building proprietors versus risks such as fire, burglary, and all-natural disasters.

For services, obligation insurance is crucial, as it safeguards versus cases resulting from problems or injuries caused by firm procedures (insurance). Building insurance coverage covers the physical possessions of an organization, while workers' payment insurance policy gives advantages to staff members wounded at work

Life insurance policy supplies economic security to beneficiaries in the occasion of the insured's fatality. Additionally, impairment insurance policy supplies income replacement if the insurance holder ends up being incapable to function as a result of health problem or injury.

Understanding the different sorts of insurance coverage is crucial for making informed choices about personal and business protection. By determining specific demands, people and companies can pick the ideal policies to reduce threats effectively.

Advantages of Having Insurance Coverage

Having insurance policy provides individuals and companies with a vital safeguard that aids reduce financial risks related to unpredicted events. Among the main advantages of insurance coverage is monetary security. By moving the danger of prospective losses to an insurance policy provider, policyholders can safeguard their possessions, whether it be a service, home, or automobile investment.

Additionally, insurance policy promotes peace of mind. Recognizing that you are secured versus significant economic problems permits people and services to concentrate on day-to-day operations without the continuous worry of unforeseen expenditures. This tranquility of mind can boost total well-being and productivity.

Insurance policy likewise cultivates stability. In the occasion of a loss, such as a natural disaster or mishap, insurance policy coverage ensures that people visit this website and services can recoup a lot more swiftly, decreasing disturbances to their lives or procedures. Several insurance policy plans use extra advantages, such as access to sources and expert advice during crises.

Finally, having insurance coverage can assist in compliance with legal requirements. Certain kinds of insurance, such as obligation coverage, are mandated by law, making sure that businesses and people run within the lawful structure while safeguarding themselves versus potential claims.

How to Choose the Right Plan

Picking the suitable insurance coverage calls for careful consideration of specific needs and conditions. Begin by assessing your particular needs, such as your financial circumstance, lifestyle, and the possessions you want to shield. Identify the kinds of protection you require, whether it's health and wellness, life, home, or vehicle insurance policy, and establish exactly how much protection is necessary to properly safeguard your rate of interests.

Next, study various insurance coverage companies and their policies. Search for firms this post with solid monetary rankings and favorable consumer testimonials. Take note of the information of each plan, consisting of costs, deductibles, coverage restrictions, and exclusions. It is critical to contrast various choices to find an equilibrium in between cost and detailed insurance coverage. insurance.

Typical Misunderstandings Concerning Insurance

Various misunderstandings regarding insurance coverage can bring about complication and poor decision-making among consumers. One prevalent myth is that insurance is an unnecessary cost, often perceived as squandering money on premiums without concrete benefits. In truth, insurance policy offers as a safety web, safeguarding individuals and families against significant financial loss.

An additional common false impression is the belief that all insurance policy policies coincide. Plans can vary commonly in insurance coverage, exclusions, and expenses. It is crucial for customers to extensively research and comprehend their alternatives to ensure they choose a plan that meets their certain needs.

Many individuals also assume that they are instantly covered for all cases under their plan. Many policies have certain exemptions and restrictions, which can lead to unexpected out-of-pocket expenses. This highlights the value of meticulously assessing the terms of any insurance policy.

Finally, some individuals think that submitting a case will certainly always cause higher costs. While this can be true in many cases, numerous insurance companies take into consideration the total danger account of a policyholder. Comprehending these mistaken beliefs is vital for making informed decisions about insurance policy and making certain proper coverage.

Conclusion

In summary, insurance coverage serves as an important system for financial protection against unforeseen events, adding to total security and assurance. By understanding the various kinds of insurance coverage offered and recognizing the advantages they give, people can make educated decisions. Choosing the suitable policy involves mindful factor to consider of individual requirements and conditions. Addressing typical false impressions better boosts understanding of insurance coverage's function in guarding assets and guaranteeing a secure future for family members and individuals alike.

The policyholder is the private or entity purchasing the insurance policy, while the insurance firm is the firm offering the insurance coverage. In the event of a loss, such as an all-natural page disaster or accident, insurance protection ensures that businesses and individuals can recuperate extra swiftly, lessening disturbances to their lives or operations.Picking the appropriate insurance plan requires cautious factor to consider of individual needs and scenarios. Recognize the types of protection you require, whether it's wellness, automobile, life, or home insurance policy, and identify how much coverage is required to effectively protect your interests.

Recognizing these misunderstandings is important for making notified decisions regarding insurance coverage and making certain correct coverage.

Edward Furlong Then & Now!

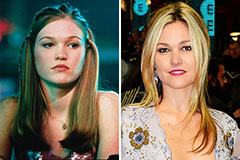

Edward Furlong Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!